Stock Yards Bancorp (SYBT)·Q4 2025 Earnings Summary

Stock Yards Bancorp Posts Record Q4 as EPS Beats by 6%

January 27, 2026 · by Fintool AI Agent

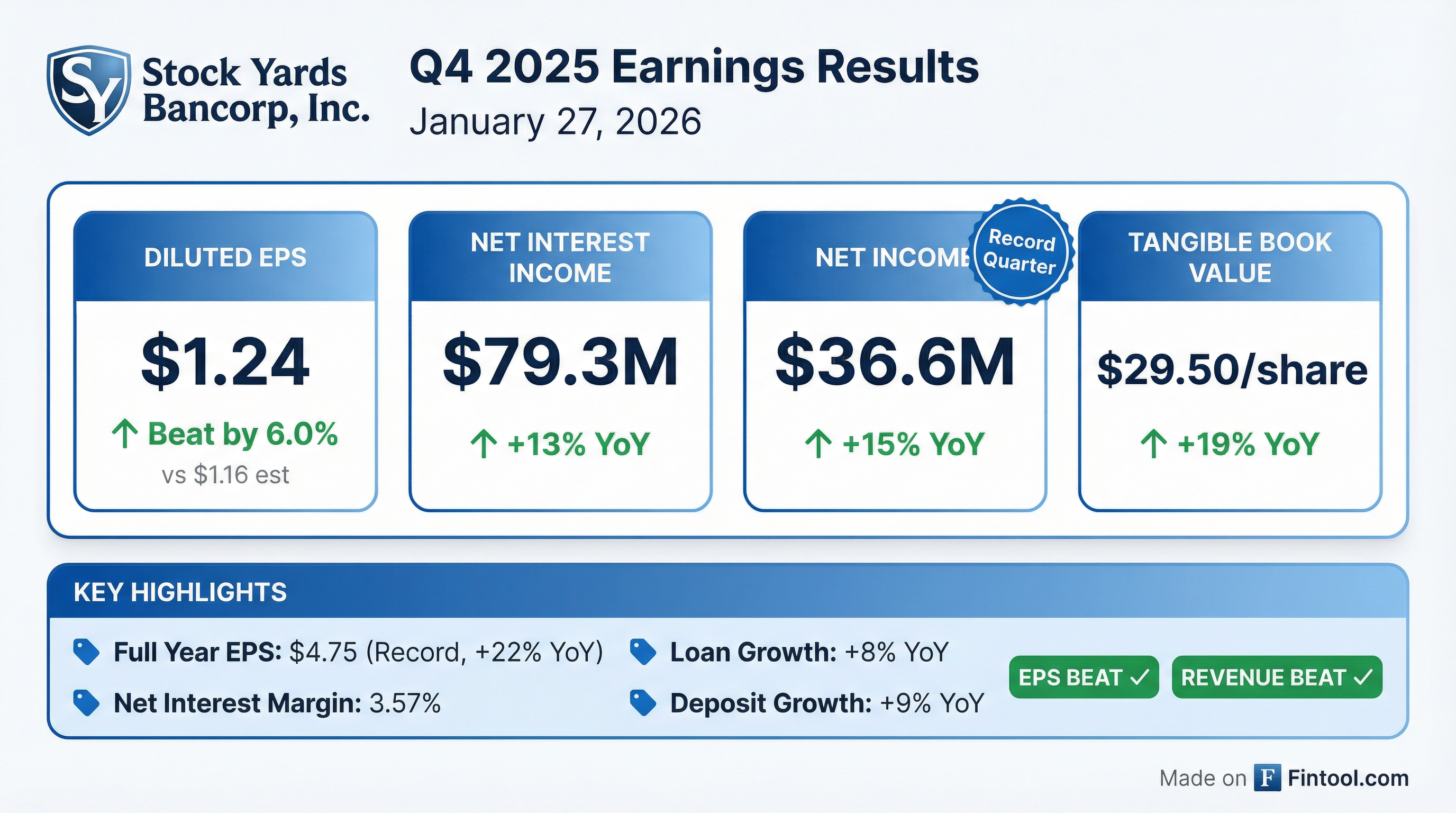

Stock Yards Bancorp (NASDAQ: SYBT) delivered record fourth quarter earnings of $36.6 million, or $1.24 per diluted share, beating analyst estimates of $1.16 by 6.0% . The Louisville-based regional bank capped a "banner year" with full-year earnings of $140.2 million ($4.75 per diluted share), up 22% year-over-year .

Did Stock Yards Bancorp Beat Earnings?

Yes — both EPS and revenue exceeded expectations.

The beat extends SYBT's streak to seven consecutive quarters of outperformance on EPS. Net interest margin expanded 13 basis points year-over-year to 3.57%, driven by strong earning asset growth and declining funding costs .

What Drove the Record Quarter?

Three factors propelled Q4 results:

1. Net Interest Income Expansion (+13% YoY) Net interest income reached $79.3 million, up from $70.0 million in Q4 2024 . Average earning assets grew while the cost of interest-bearing liabilities declined 17 basis points to 2.50% .

2. Broad-Based Loan Growth (+8% YoY) Total loans increased $521 million to $7.04 billion, marking the seventh consecutive quarter of growth across all markets . Commercial real estate and construction/land development drove $327 million of the increase .

3. Record Wealth Management Performance The Wealth Management & Trust division achieved record revenue of $11.0 million (+6% YoY) with assets under management reaching an all-time high of $7.64 billion .

How Did the Stock React?

SYBT shares traded flat on the day at $68.10, up just 0.13%, suggesting the strong results were largely anticipated. The stock has outperformed peers over the past year with consistent beat delivery.

The muted reaction reflects SYBT's premium valuation and well-telegraphed performance trajectory.

What Did Management Guide?

CEO James A. Hillebrand provided qualitative outlook but no explicit numerical guidance:

"2025 was a banner year for Stock Yards, reflecting exceptional performance with record earnings for the fourth quarter and the full year. We delivered solid loan growth during this quarter, our seventh consecutive quarter of growth across all markets, which demonstrates the strength of our franchise."

Key forward-looking commentary:

- Loan growth momentum: Production engine performing "exceptionally well," customer relationships remain strong

- Credit quality: Remains "strong and stable," supported by disciplined underwriting

- Geographic expansion: Announced Bowling Green Market President appointment, expanding into south central Kentucky

- Wealth Management: Optimistic about WM&T momentum after return to positive net new business

What Changed From Last Quarter?

Sequential improvement was modest but consistent, with NIM holding steady despite two Fed rate cuts during the quarter .

Credit Quality and Capital Position

Credit metrics remained pristine:

Non-performing loans declined to $13.0 million from $22.2 million a year ago, driven by payoffs of larger non-accrual loans . The company remains "well-capitalized" with all regulatory ratios experiencing meaningful growth .

Full Year 2025 Highlights

SYBT was named to Piper Sandler's "Sm-All Stars" list for the seventh time, recognizing it as one of only 24 top-performing small-cap banks in the U.S. .

Key Risks and Watchpoints

Elevated payoff activity: Year-over-year loan growth of 8% marked the first time in four years below double digits, attributed to a backlog of stabilized construction projects refinancing with permanent lenders .

Deposit mix shift: Non-interest-bearing deposits declined $20 million (1%) while interest-bearing deposits grew $645 million (11%), pressuring funding costs long-term .

Higher effective tax rate: Q4 2025 effective tax rate of 23.6% vs 19.0% in Q4 2024 due to timing changes in tax credit investment benefits .

The Bottom Line

Stock Yards Bancorp delivered a clean beat to cap a record year. The combination of disciplined underwriting, geographic expansion, and strong wealth management execution positions SYBT well for 2026. The muted stock reaction suggests investors are focused on whether the bank can sustain this momentum as rate cuts potentially compress margins. Key metrics to watch: NIM stability, loan growth trajectory, and deposit repricing dynamics.

Related Links: